Portfolio Details

Loan Default Prediction

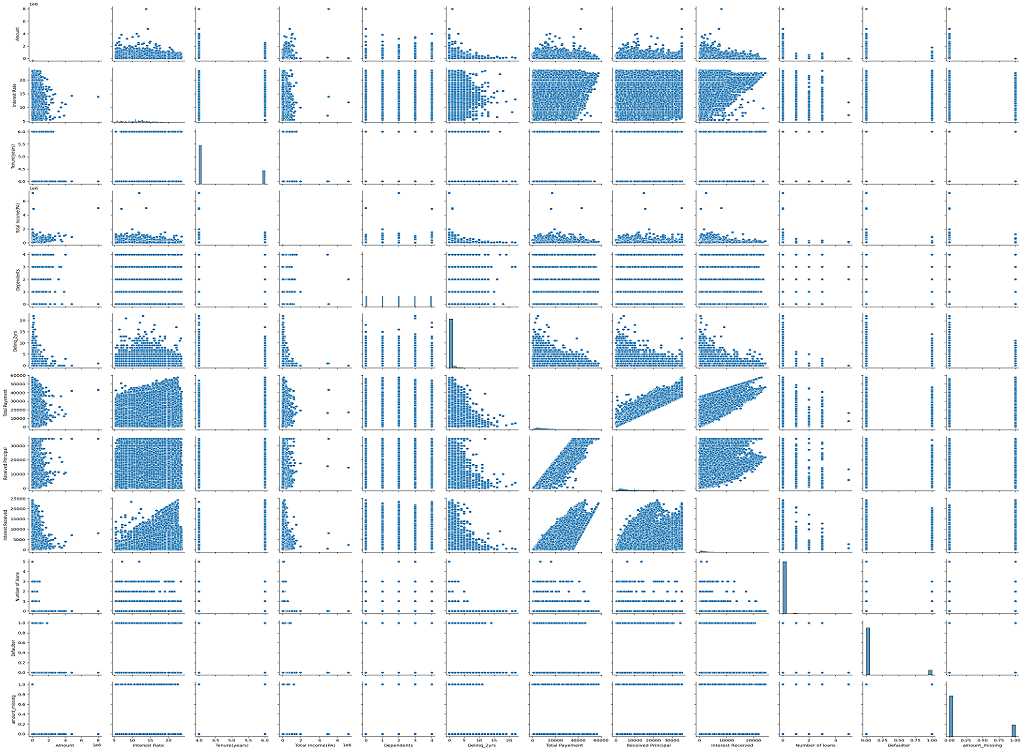

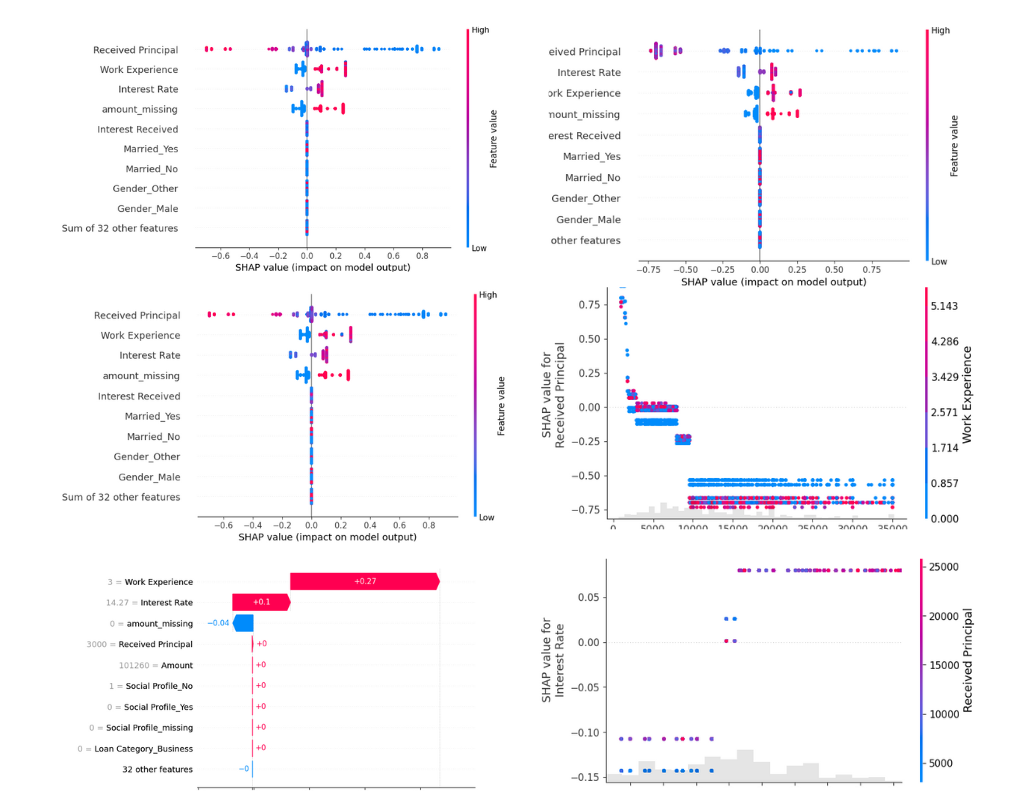

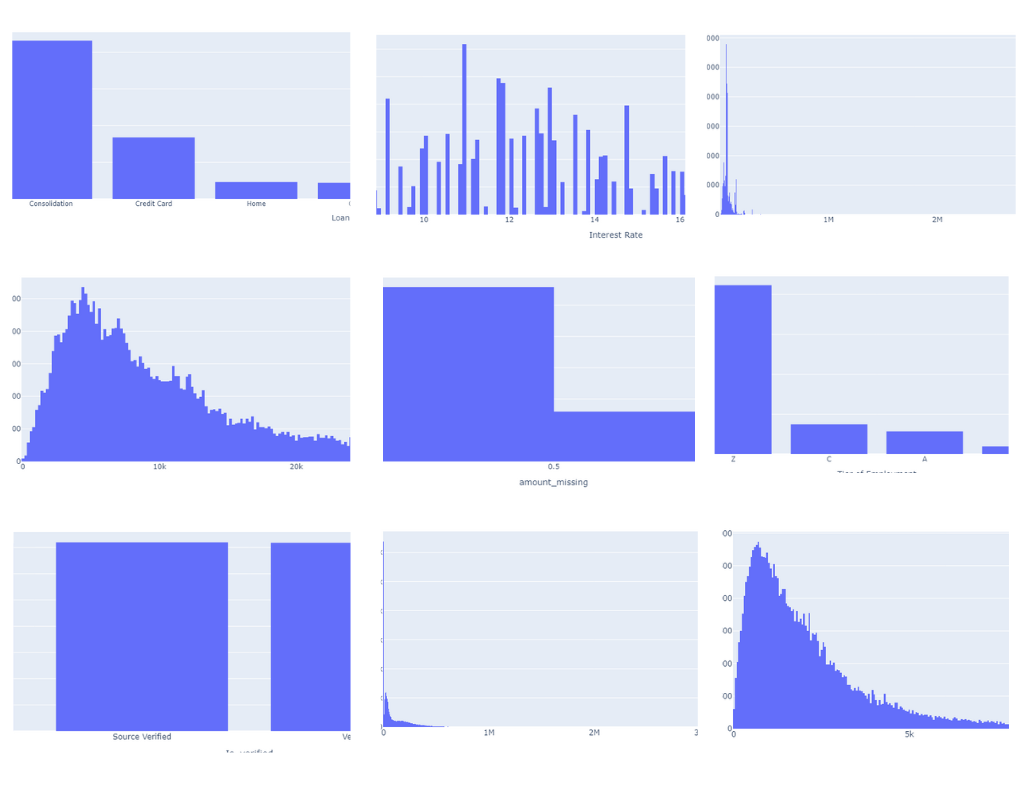

This project focuses on developing robust AI models for predicting loan defaults in the banking sector using Python. By leveraging advanced machine learning techniques, it aims to enhance the accuracy and reliability of these predictions while ensuring transparency and interpretability through Explainable AI (XAI) methodologies.

Problem Statement

In the banking industry, accurately predicting loan defaults is paramount for managing financial risks effectively. However, the inherent complexity of AI models used in this process often leads to challenges in understanding how decisions are made. This lack of transparency can undermine stakeholder trust and hinder regulatory compliance efforts.

Goal

The goal is to integrate Explainable AI (XAI) into loan default prediction models to provide clear insights into decision factors. This approach empowers data scientists, business executives, and regulators to make informed decisions, thereby improving model reliability and compliance.

End Result:

Implementing XAI in our banking AI systems will achieve:

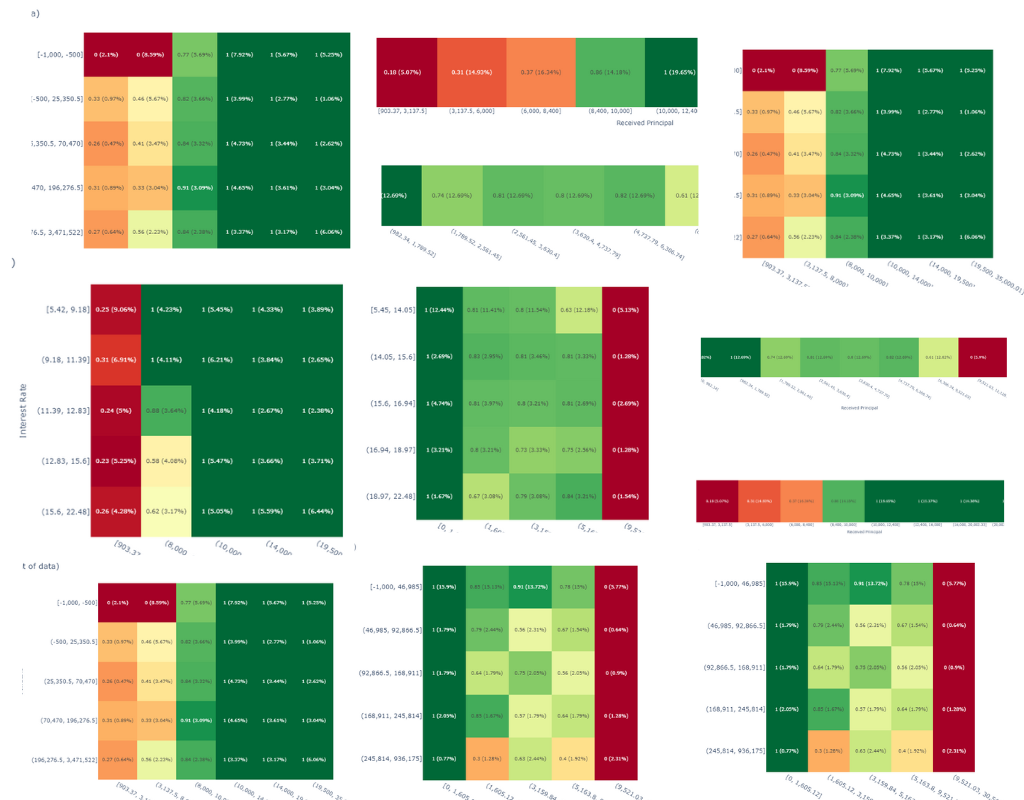

- Data Scientists: Enhanced model transparency through tools like SHAP values, enabling precise identification of key factors (e.g., credit score, income) contributing to loan defaults. This facilitates robust model development and refinement.

- Business Executives: Improved decision-making with a deeper understanding of model outputs (e.g., precision, recall), crucial for setting loan approval policies that balance risk and customer satisfaction.

- Regulators: Increased compliance and fairness by providing clear explanations of AI decisions, mitigating biases, and ensuring that AI models meet ethical and legal standards.

Project information

- Tools: Jupyter Notebook , Python

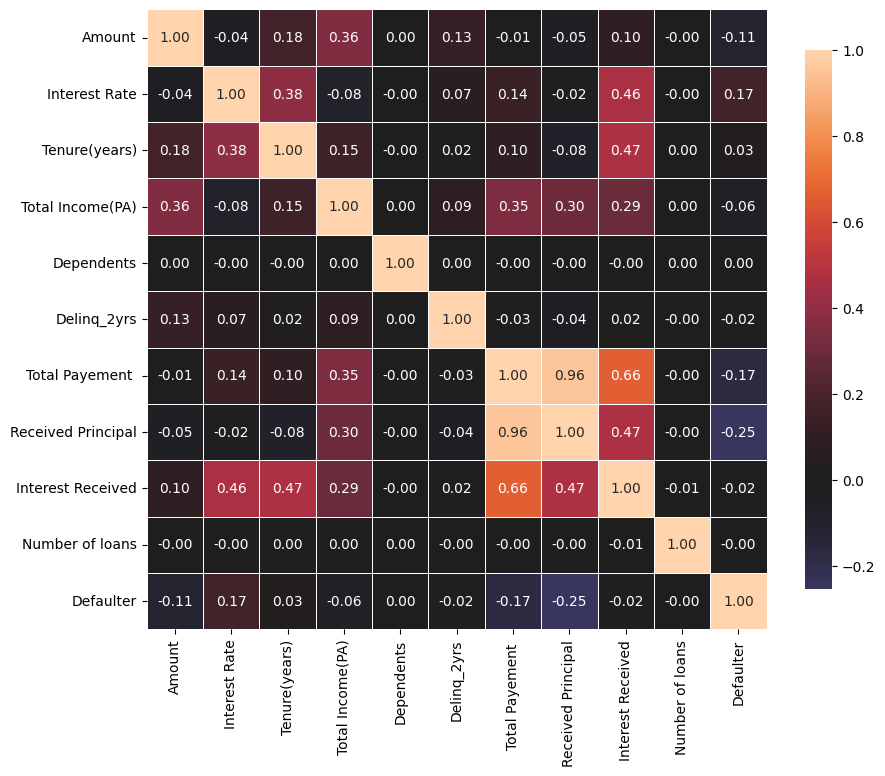

- Libraries: pandas,numpy,seaborn,scikit-learn,matplotlib,neptune,xgboost

- Project date: 26 June, 2024

- Project URL: Github Link